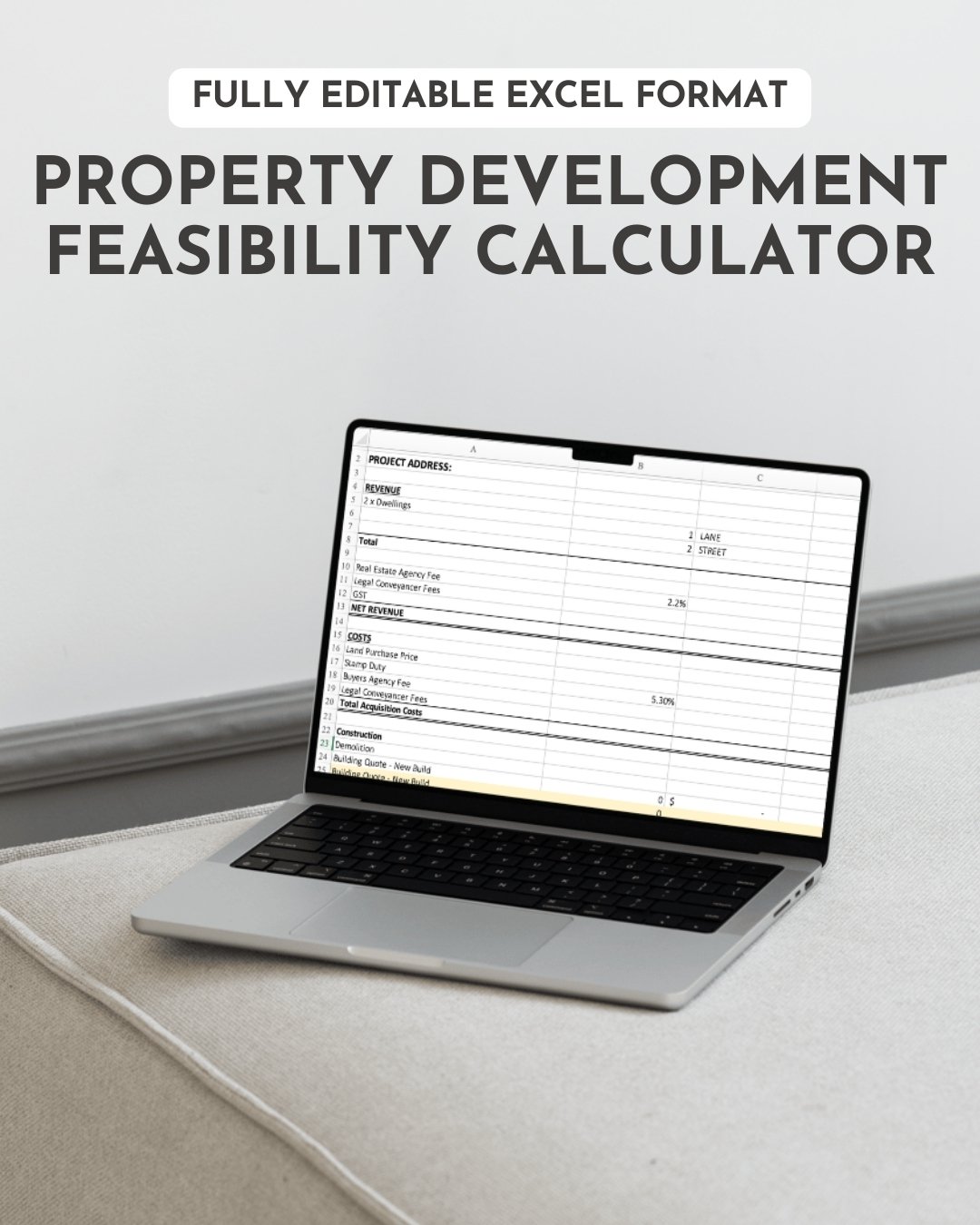

What this calculator does

Why this tool is different

This is not a generic online calculator or simplified feasibility template.

It reflects how real projects are assessed — conservatively, methodically, and with enough detail to expose risk early. It forces you to account for costs that are often overlooked or underestimated, and it shows you how small changes in assumptions can dramatically affect profitability.

This is the same framework The Designory uses when:

assessing sites for development

advising clients on feasibility

pressure-testing renovation vs rebuild decisions

comparing multiple project scenarios

Important note

This calculator is a decision-making tool, not financial advice. All costs should be reviewed with your accountant, lender, and professional consultants before proceeding with a project. The accuracy of outputs depends on the accuracy of your inputs.

The Designory approach

We believe better projects come from better information. This calculator exists to remove guesswork, surface risk early, and help you design — and develop — with clarity.

If you’re serious about understanding whether a project works before you commit, this tool belongs in your toolkit.

This spreadsheet allows you to run a full development feasibility from start to finish, including:

Projected revenue

Multiple dwellings (lane, street, dual occupancy or more)

Flexible inputs for finished values

Net revenue calculations after selling costs and GST

Acquisition costs

Land purchase price

Stamp duty (percentage-based)

Buyer’s agent fees

Legal and conveyancing costs

Construction costs

New builds and renovations (per dwelling or $/m²)

Demolition

Home Owners Warranty Insurance (HOWI)

Contingency allowances (industry standard 10–20%)

Automatic subtotals and totals

Planning & consultant fees

Town planning

Surveying

BASIX / NatHERS

Architectural and interior design

Engineering (structural, hydraulic, geotechnical)

Bushfire and heritage consultants

Project management costs

Administration and bookkeeping

Monthly project management fees over the project duration

Finance & holding costs

Property and construction loans

LVR-based loan calculations

Interest rates and loan duration

Application fees, valuations, QS reports

Mortgage insurance and bank fees

Council fees & statutory charges

PCA and council fees

Long service levy

DA lodgement

Subdivision certification

Section 94 / development contributions (NSW)

Clear profit outputs

Profit before finance

Total costs including finance

Final profit post-finance

All formulas are already built in. You input your numbers — the calculator does the work.